What lies ahead for the local housing market in 2018? We sat down with Windermere Chief Economist Matthew Gardner to get his thoughts. Here are some highlights:

Home prices will continue to increase, but at a slower pace

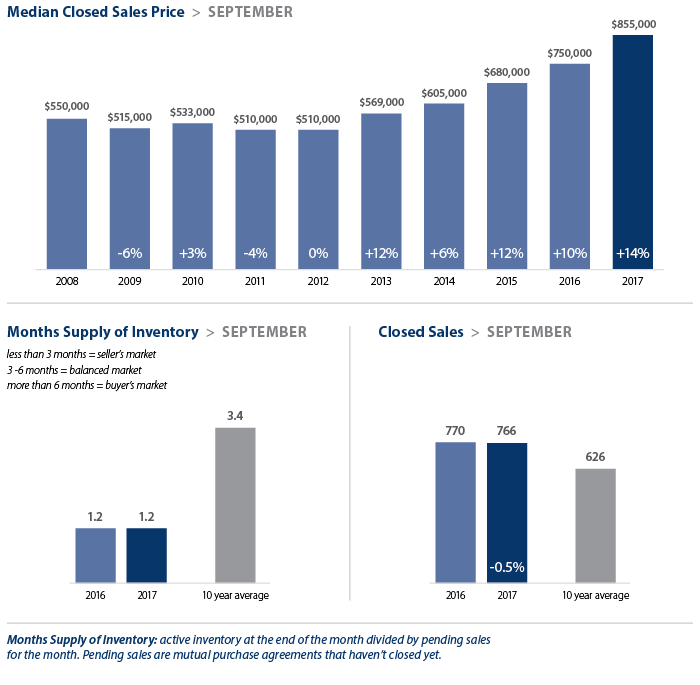

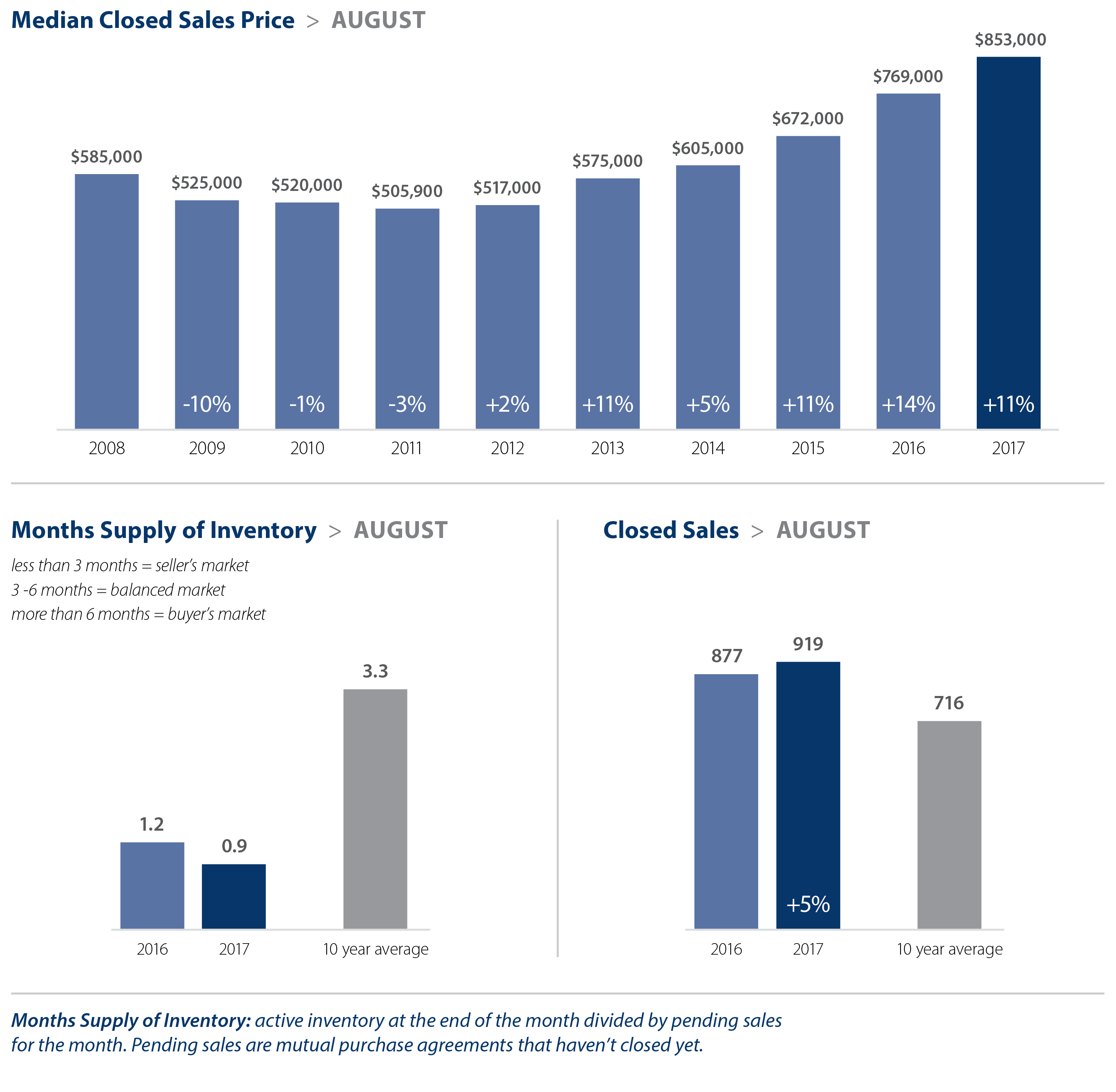

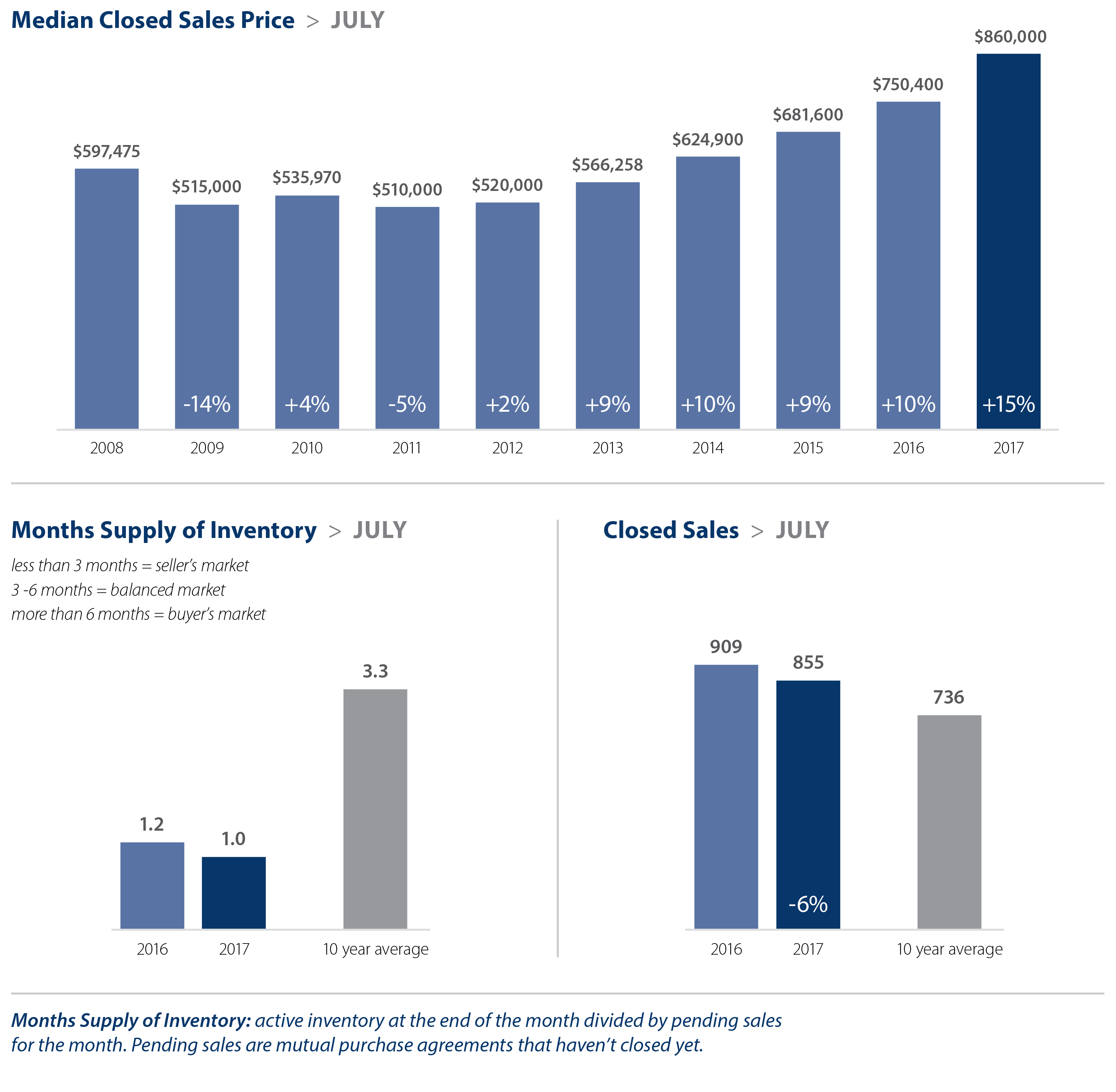

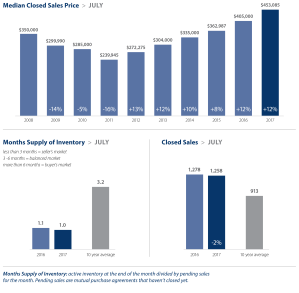

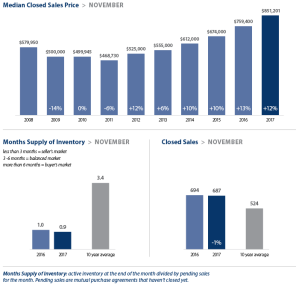

The strong local economy, high demand and very low inventory will continue to boost home values in 2018, according to Gardner. However, he believes that the double-digit growth of 2017 will moderate, and predicts home prices in King County will rise by 8.5% in the new year.

Mortgage interest rates will rise slightly.

Gardner admits that interest rates continue to baffle forecasters. The rise that many economists have predicted the past few years has yet to materialize. His forecast for 2018 sees interest rates increasing modestly to an average of 4.4% for a conventional 30-year fixed-rate mortgage.

More Millennials will enter the housing market.

Despite the relatively high cost of homes in our region, Gardner expects more Millennials to buy homes in 2018. They are getting older and more established in their careers, enabling them to save more money for a down payment. Many are also having children and are looking for a place to raise their family.

The tax reform bill will have a limited effect on our housing market.

The recent changes to the income tax structure will have an impact on homeowners, but Gardner does not believe that impact will be significant here.

-

-

The mortgage interest rate deduction will be capped at $750,000 – down from $1,000,000. But according to Gardner, just 4% of the mortgages in King County exceeded $750,000 in 2017. Most buyers of more expensive homes have been making larger down payments, or buying homes for cash.

-

Since the $1,000,000 mortgage deduction cap is grandfathered in for those who have already purchased a home, some homeowners may opt to stay put rather than move. That could result in fewer homes being placed on the market.

- The tax bill eliminates the deduction for interest on home equity loans. This is bound to slow down the trend of homeowners choosing to remodel their home rather than trying to find a new home our inventory-deprived market.

-

Bottom Line

The increase in home prices may moderate, but inventory will still be very tight. 2018 is on track to be a strong seller’s market.

This post originally appeared on Windermereeastside.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

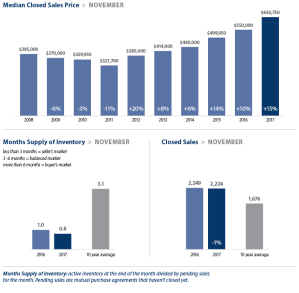

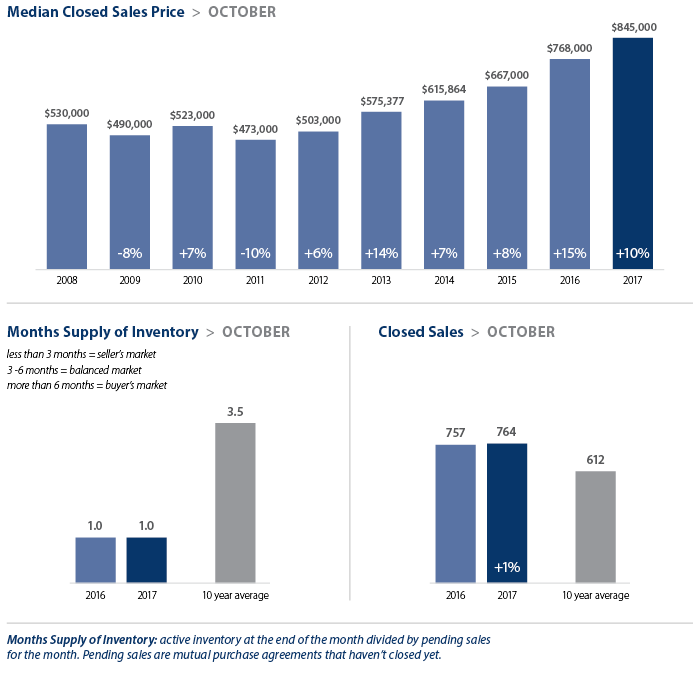

Given tight supply levels, it is unsurprising to see very solid price growth across the Western Washington counties. Year-over-year, average prices rose 12.3% to $474,184. This is 0.9% higher than seen in the second quarter of this year.

Given tight supply levels, it is unsurprising to see very solid price growth across the Western Washington counties. Year-over-year, average prices rose 12.3% to $474,184. This is 0.9% higher than seen in the second quarter of this year.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the third quarter of 2017, I have left the needle at the same point as the second quarter. Though price growth remains robust, sales activity has slowed very slightly and listings jumped relative to the second quarter. That said, the market is very strong and buyers will continue to find significant competition for accurately priced and well-located homes.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the third quarter of 2017, I have left the needle at the same point as the second quarter. Though price growth remains robust, sales activity has slowed very slightly and listings jumped relative to the second quarter. That said, the market is very strong and buyers will continue to find significant competition for accurately priced and well-located homes. Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.